This is a simple beginner’s guide on what is Forex Trading. Most beginners wonder how to get into forex trading yet it’s very easy. This industry is like a game where you can make money by simply understanding how currencies from different countries are affected.

The exciting part in forex trading is that you can make profits from both rising and falling markets and you don’t need too much money to start trading. Don’t look at successful traders and assume that they started trading with huge sums of capital. Most of them started with little capital and with clever moves, make their small accounts grow overtime, though of course starting with reasonable amount is better if you can

In this industry, learning is a continuous journey and each market move is a lesson in the school of financial independence.

Key points to note about What is Forex Trading.

The forex Market is where national currencies of different countries are exchanged.

These currencies are traded against each other in pairs. For example GBP/USD means the British Pound is traded against the U.S dollar.

You need a trusted forex broker that acts as a middleman to link you to the forex market so that you can easily trade.

Learning is continuous.

You do not need a huge amount of funds as initial capital to start trading.

Forex trading is flexible therefore a trader can easily balance trading with other commitments and opportunities are always available providing a chance to turn spare moments into potential profits.

What is Forex Trading?

Forex trading involves the exchange of one currency for another with the aim of profiting from fluctuations in their relative values.

It is basically the value of a currency over other foreign currencies on the foreign exchange market.

Forex =foreign exchange

What is a Forex Pair?

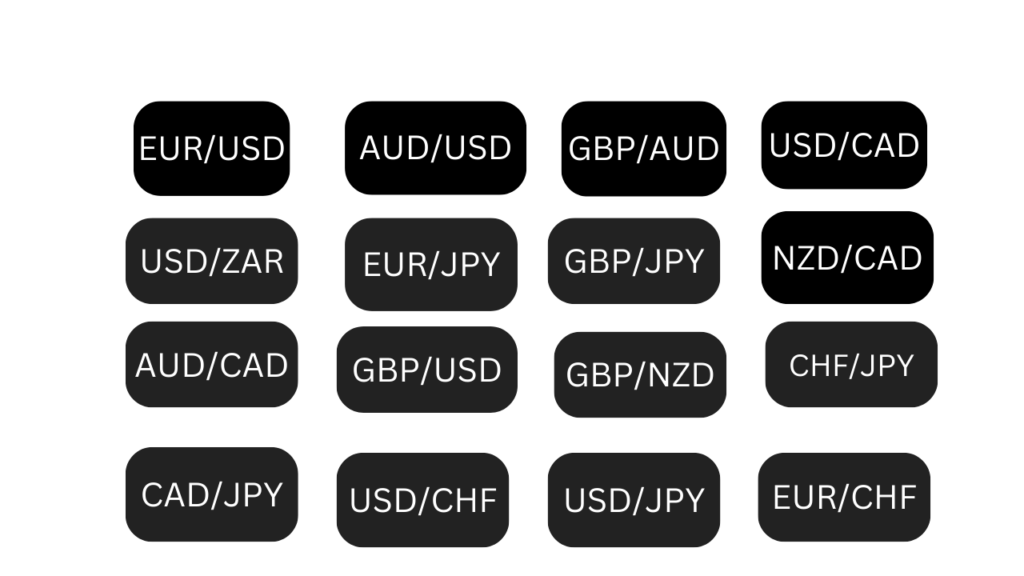

A forex pair is when two currencies are combined and traded against each other.

In the world of Forex, currencies are traded in pairs. Each pair consists of a base currency and a quote currency. The exchange rate reflects the value of the base currency in terms of the quote currency. For instance, in the EUR/USD pair, the euro is the base currency, and the U.S. dollar is the quote currency.

Below are some examples of currency pairs

What To Consider To Start Trading.

Forex trading is a personal journey and here are some steps to get yourself started.

1.Learn the Skill/basics first.

Just like you learn to do anything, Forex trading also requires learning. Having the knowledge and discipline are key.

2.Create a trading account with a broker.

Most beginner traders face this challenge of selecting a trusted broker to use and that’s why it’s best for every beginner to seek guidance from other experienced traders who are more familiar with the available options. Experienced traders are like a compass guiding you to the right direction and making things easier. Below are some of the Brokers I use and highly recommend.

3.Develop a trading plan or a strategy.

Your trading plan is like a treasure map showing you where to go and how to get there. As a trader, you are required to have your trading plan that guides you on what to look for when entering and exiting the market, your risk management and discipline when in the market.

4.Practice on a Demo account.

Practicing on a demo account is highly advisable because it helps you set your trading rules and also enables you gain confidence when you start trading on a real account. Remember a demo account is like a game where you can freely practice and learn without using real money.

5.Discipline.

Teach yourself how to control your emotions and identify major levels when you are supposed to take entries and when you are to close your positions. As a trader, you must know when to enter and exit the market.

6. Have a Bank account/online account.

Every trader is required to have an account where he can easily do transactions with their preferred broker.

In this world of trading , knowledge is your best friend, experienced traders are your guides , your trading plan or strategy is your map to success, a demo account is your practice ground and being disciplined is like being the captain of your ship.

With these above tools, you will be a great trader .

Types of Traders.

There are different types of traders and as you practice on your demo account, it is important to know whether you are a short term or long term trader because you will be required to identify the type of trader you will be basing on the strategy you will have come up with.

Trading strategies differ therefore if you are a short term trader, your approach to the market is very different from how a long term trader approaches the market.

Market analysis basing on technical, fundamental or sentimental approach is key because it’s what traders base on to build their trading strategies.

Long term traders need to also be aware of the over night charges for holding open trades for along period of time.

There are different types of trades in the market with each having a distinct approach.

Scalp Traders

They hold positions for seconds or minutes and they take quick trades aiming for small profit margins often measured in pips.

Day traders

They can hold positions for minutes, hours, but do not exceed a day. they mainly capitalize on short term market movements.

Swing traders.

These hold positions for days or even weeks.

Position traders.

They hold positions for a very long period of time sometimes spanning months or even years.

Its key to remember that each type of trader has got their own set of strategies and risk tolerance catering to different market conditions and individual preferences.

Understanding these distinctions can help traders align their approach with their financial goals and time commitments.

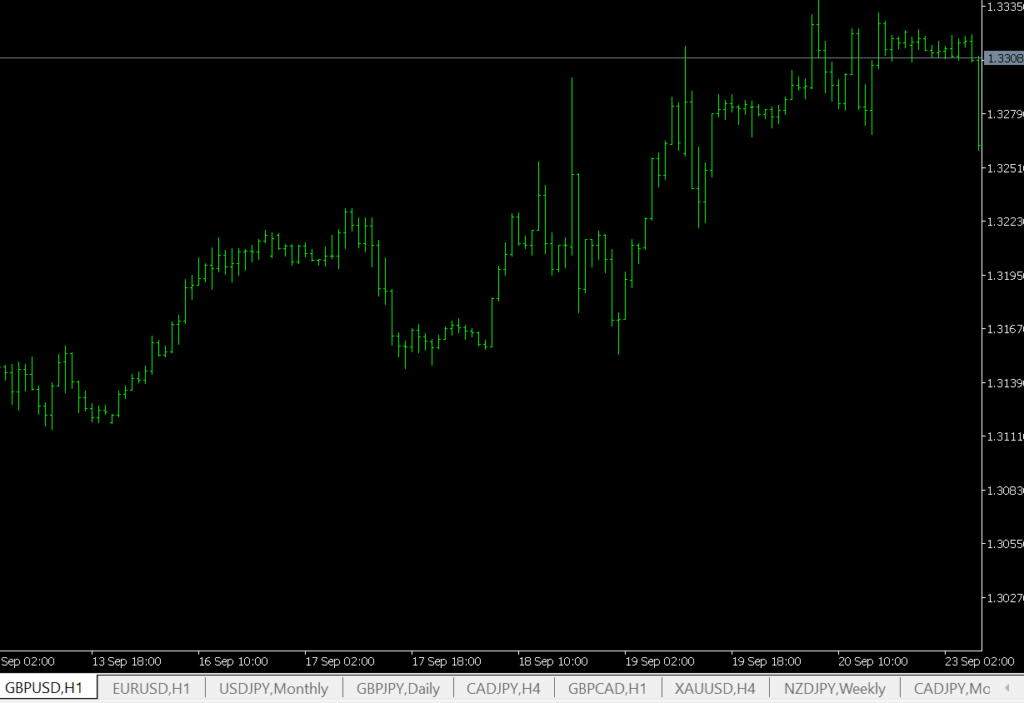

Types of Charts used in Forex Trading.

There are mainly three types of charts namely,

1.Bar Chart.

Traders do not commonly use these but guide traders to easily identify a bearish or bullish market using bars as shown below. The bar chart shows the opening, high, low, and closing prices for each time interval, with each bar representing the price range within that timeframe

2.Candlestick Chart.

This is the most used chart and can also be in different colors basing on what the trader wants. Red or Black candlesticks mean the market is in a bearish movement then a white or green candle stick means the market is in a bullish market.

3.Line Chart.

These charts clearly show the opening and closing price of each.

Forex Trading Terminologies.

Every trader must learn and know the trading language so that they can easily understand what is being communicated.

Below are some of the terms used in forex trading.

1.Ask price or Offer price.

This is the lowest price at which you are willing to buy a currency on the forex market.

2.Bid price.

This is the highest price at which you are willing to sell a currency.

3.Contract for difference.

The contract for difference (CFD) enables traders to trade.

4.Leverage.

This refers to using borrowed funds to multiply your returns. Therefore a higher leverage is of an advantage to every trader.

5.Margin Call

This is when the equity of the trader has dropped below a certain amount or percentage that was set by the broker. This will require the trader to add more funds to hold running positions/trades or the broker will automatically close the running trades/positions

6.Equity

This is the total funds that a trader has including running positions can be profits or loss. If the trader is running in profits, it will be balance plus the running profits, if the trader is running in losses, it will be balance minus the losses

7.Margin

This is the amount of the balance that a trader needs to open a position or hold the current position/trades

8.Gap

This is a significant price change in the market and will reflect on the chart as there was no trading activity by displaying space