This article is a simple guide on types of market trends in trading. A market trend is the direction the market is moving towards because of demand and supply factors.

Market trends are so crucial in trading because they guide traders in making decisions on how and when to enter and exit the market.

Its also important to know that market trends occur in any timeframe therefore every type of trader can consider using trends with the guidance of technical, fundamental and sentimental analysis to take their trades.

Below is an illustration of a market trend.

Its also key to note that a trend in a higher timeframe for example monthly or weekly can be extremely different from the trend in smaller timeframes like h4,h1,m30 etc. therefore every trader basing on their trading style must be aware of the different trend patterns that occur in different timeframes.

But its important to always consider the market trend analysis in higher timeframes so as to easily forecast the possible levels the market is likely to reach.

Whatever you are doing has to lead you to a decision of whether to buy or sell in the market. You need to understand the type of movement the market is making.

All markets make those same movements therefore its up to you to understand the trend the market is making so that you can make a decision of whether to buy or sell.

Key points to note about types of market trends.

1.The market trend helps you understand the direction the market is moving in.

2.Understanding the turning points of the trend guides you identify your area of entry.

3.Keep in mind the possibility of retracements in the market.

4.The market will always create for you an opportunity to sell or buy no matter the trend.

5.Avoid going against the trend. If the market is on an uptrend, strictly look out for buy opportunities and vice versa. This is to avoid making unnecessary losses.

6.These types of market trends occur in any timeframe.

7.These movements do not move in a straight line but rather a trader is required to identify upwards, downwards and sideways market.

The different types of market trends.

Market trends in trading are categorized into 3 parts. The uptrend, downtrend and the consolidating market.

1.Uptrend movements.

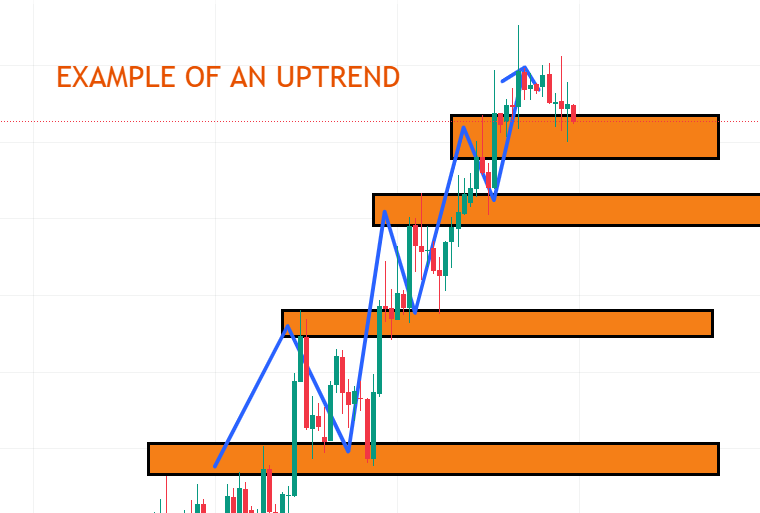

This is situation whereby the market is making upward movements of prices in a certain period of time. An uptrend is also known as the bullish trend indicating that buyers are strong in the market.

An uptrend moves in phases of accumulation, recovery and distribution.

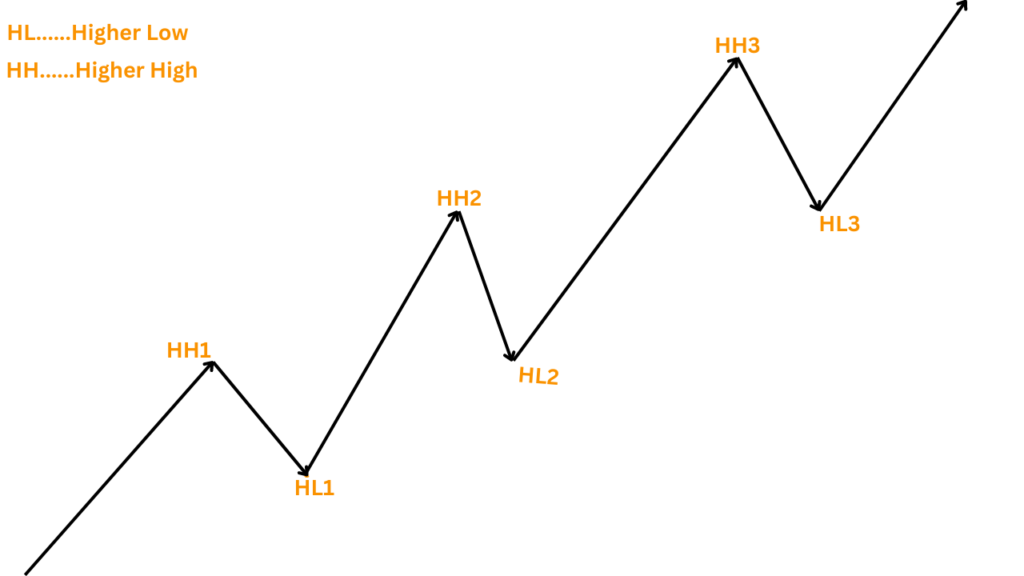

The market makes higher highs and higher lows giving u an opportunity to look out for buy entries as illustrated below.

A trader is required to only be looking out for buy entries. Avoid trading against the trend because you will end up making unnecessary losses. When the market is on an uptrend, it will be making highs that are higher than the previous ones.

During a market retracement in an uptrend, the market will be making a higher lows. Kindly note that a valid higher low does not surpass the previous higher low that was created and these turning points are very important. The moment the series of higher high and higher lows changes, it means the market is no longer interested in moving in that direction. Therefore if the trend is broken then you can know start looking out for possibility of change in trend.

2.Downtrend.

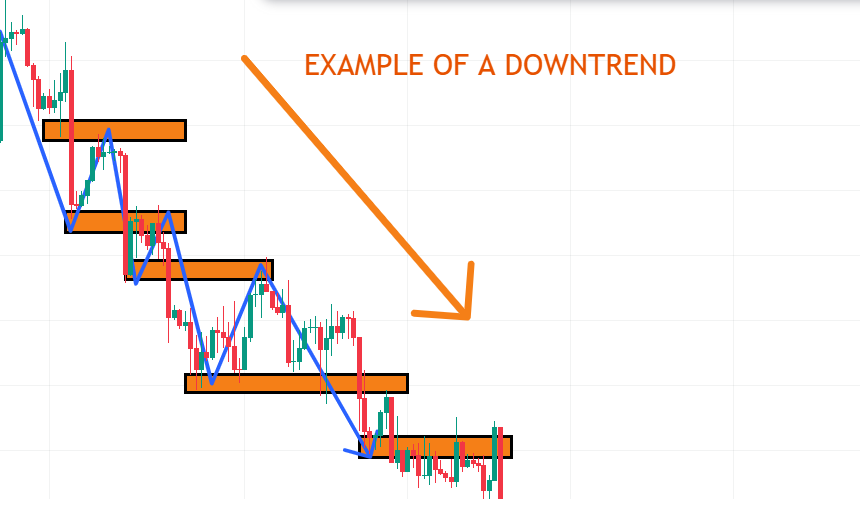

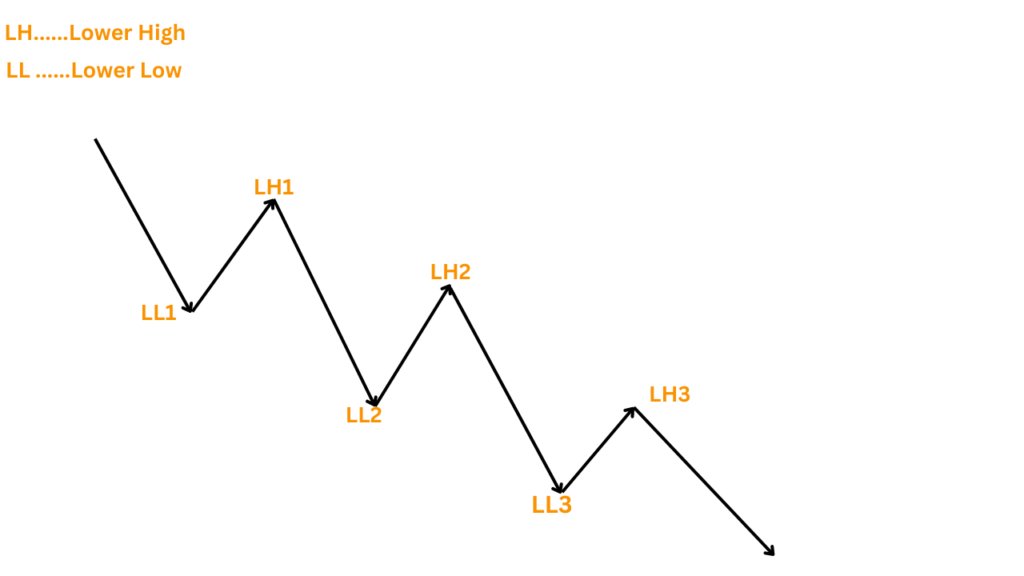

Its also known as the Bearish trend. The market makes lower lows and lower highs.

The trader will be looking out for sell entry and please avoid trading against the trend. When the market is on an downtrend, it will be making lows that are lower than the previous ones as illustrated below.

During a market retracement in a downtrend trend, the market will be making a lower lows. Kindly note that a valid lower low must not surpass the previous lower low that was created and these turning points are very important. The moment the series of lower low and lower lows changes, it means the market is no longer interested in moving in that direction. Therefore if the trend is broken then you can know start looking out for possibility of change in trend.

3.Consolidation/raging.

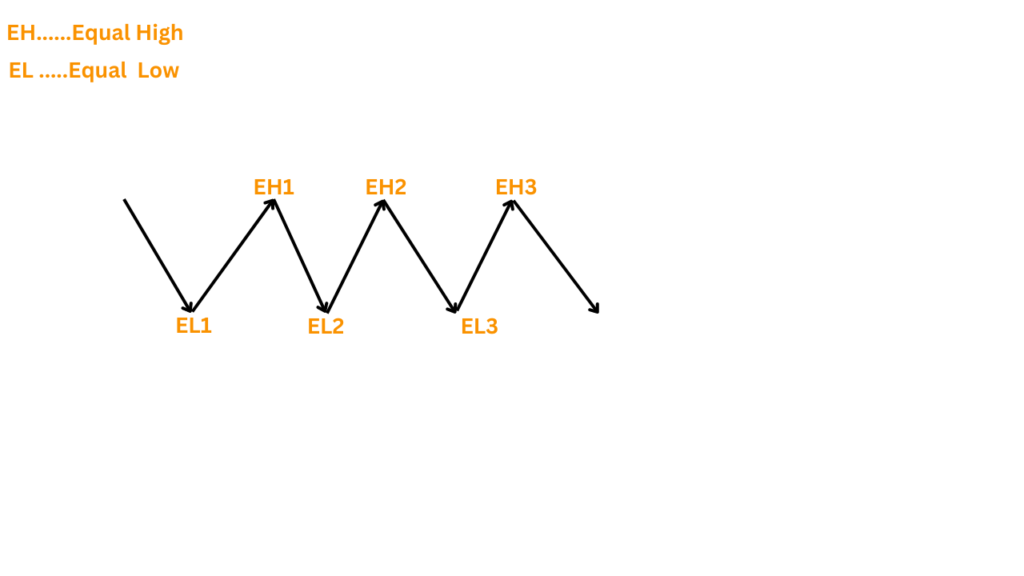

This is also a sideways market. Its a situation whereby the market is moving while making equal highs and equal lows. The market is moving but not breaking the turning points it had created. But rather the market moves while creating structures and its not breaking to go either up or down.

When the market is making lows and highs without breaking the previous highs and lows that is an indication that the market is consolidating.

If the cosidation area is broken either upwards or downwards, then that means that there is a change in trend.

When in the market, you must know and identify a movement. Forexample if the market is making lower lows, u need to wait for the retracement up and create a higher low so that you can look for areas of entry.

How to identify where to take entries.

For a beginner failing to understand candlestick chart, you can use a line chart that will clearly show all turning points

You can trade freely and practice on demo account using any of your preferred broker here.

Create a deriv demo account, CLICK HERE

FAQS about types of market trends.

1.What are the different types of market trends?

Uptrend market

Downtrend trend

Consolidating/Sideways trend.

2.What are market trends in trading?

A market trend is the direction the market is moving towards because of demand and supply factors.

3.How to identify market trends in trading?

When the market is making higher highs and higher lows, that’s an uptrend.

When the market is making lower lows and lower highs, that’s a downtrend.

When the market is market is making equal highs and equal lows with breaking any side, that’s a consolidating market ranging market.