This article is about the best timeframes for intraday trading. First, we will need to understand what intraday trading is. Intraday trading also known as day trading involves monitoring price movements with the help of technical analysis so as to profit from the short term price movements within a day. Intraday traders hold trades for hours and do not exceed a day.

What to note about the Best Timeframes for Intraday Trading.

Different types of traders have got their own trading style and approach with different trading rules. Some of the key points for intraday traders include,

1.An intraday trader must have proper risk management and discipline when in the market. No matter the amount you have invested in market, you must be having a specific amount beyond which you are not willing to loose. This helps to avoid blowing your account.

2.Have a daily target to attain. An intraday trader is required to have a set a target basing on market analysis made. Once you have attained your target, it’s better to exit the market since there is a possibility of retracements that could reduce on profit that could be made.

3.A day trader must have proper fundamental and technical skill. This is mainly to guide the trader of the possible future economic news that can cause volatility in price movement.

4.Requires good skill and proper market knowledge.

5.Trader must have quick decision making so as to easily execute quick trades.

6.Avoid over trading. It’s important to plan what you will be trading for the day. This involves selecting a few pairs to closely analyze with an aim of selecting the best options that have clear structure and respect your trading rules.

7.Journal your trades. Its very important to record your trades as it will guide you to easily identify the good and wrong decisions you made for that specific trading day.

The best timeframes for intraday trading.

This article will guide you on the best timeframes for Intraday Trading. A trader will have to check price movement on the different charts of different timeframes. This guides a trader to make proper decision during market analysis of when to enter and exit the market.

Intraday traders must also keep in mind that multi-timeframe analysis is so important when doing market analysis since information for one timeframe is not sufficient enough to make proper analysis decisions.

Below are the best timeframes for Intraday Trading each having it’s uses.

1.Direction timeframe.

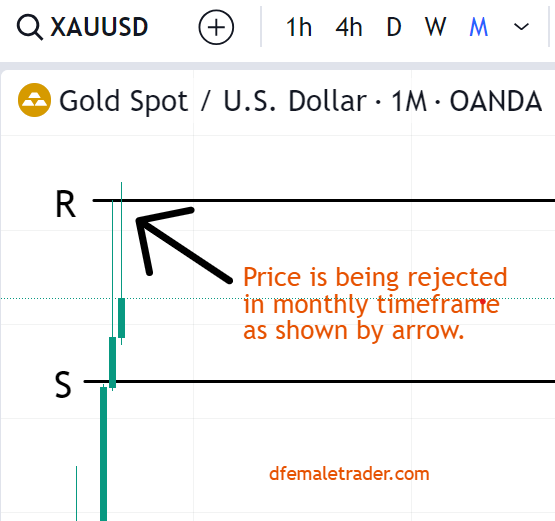

All traders are required to have a directional timeframe though personally I prefer the monthly timeframe. You can choose any timeframe that you will be able to use as a direction timeframe.

2.Structure timeframe.

For purposes of identifying the market structure , intraday traders can use the daily timeframe or any of their preference.

3.Entry timeframe.

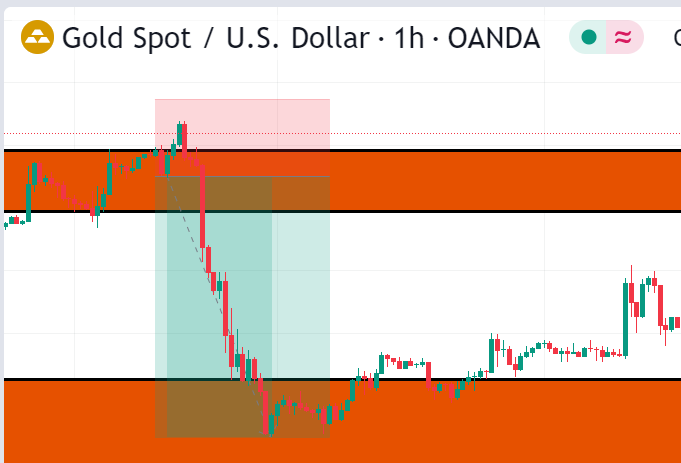

Intraday traders can use H1 timeframe for entry. Remember a day has got 24 H1 candlesticks, therefore you will be able to identify your confirmation candlesticks of your preference to enter and exit the market.

A trader can also identify the weak retest in this timeframe so that they can sense a possible reversal or a retest or a change of trend.

The reason as to why we don’t use H4 timeframe for entry is because a day has 6 candlesticks each indicating 4 hours of price movement and a trader may not be able to easily identify their confirmation candlesticks leading to missing out on trades.

The above only applies only if you used monthly as direction and daily as structure timeframes. Incase you used different timeframes, you can organize them as in this example.

If you chose daily timeframe for direction, means H4 and H1 can be for structure and M15 and M30 for entries.

4.Refining timeframe.

The main reason as to why minute timeframes are among the best timeframes for Intraday Trading is because a trader is able to take earlier and better entries with proper structure. Day traders use minute timeframes like the M30 or even M15 to refine their trades so that they can quickly execute their trades.

Even though minute timeframes are mostly used by scalpers, intraday traders also use them with the guide of their short term scalping strategies that require close market monitoring and quick market execution.

With the above steps ,one should now be able to select Best Timeframes for Intraday Trading for him/her self.

What are Benefits of intraday trading.

Day trading comes with very many benefits and some include,

1.Overnight charges. They don’t suffer charges for holding trades for a long period of time.

2.Intraday traders easily make quick profits since they utilize the short term price movements in the market.

3.With proper analysis, intraday traders maximize all the trading opportunities in the market leading to high level of accumulated profits attained from the market.

4.Improves on the trader’s skill

Even though day trading has got many advantages, it has got disadvantages to. Day traders with less time to monitor price movement end up making huge losses that causes a lot of emotional torture. This is mainly because day trading demands a lot of quick decision making to execute trades.

FAQs about Best Timeframes for Intraday Trading.

1.What is intraday trading

Intraday trading involves taking trades in the market and closing them within the period of that same trading day.

2.How to handle emotions in day trading.

The best way to handle your emotions as a day trader is avoiding going against your trading rules and avoid over trading. Ensure to strictly trade set ups that you have properly analyzed.

3.What timeframes are recommended for intraday trading.

The best times for intraday trading include monthly, daily, H1 and minute timeframes each having a distinct use as explained in the article.

Read also: Types of Market Trends.